Introduction

Why do I believe the investment in British Steel is good

Over the past 50 years successive Governments have not taken steel production in the UK as seriously as they should. Given the instability of Geopolitics today, Government and industry now realise it is essential for the UK to invest in steel production.

I’ll be honest, the idea that we invest in supporting a business under foreign ownership (Jingye Group) with taxpayers money sticks in the throat. After all, myself and other UK business owners have to do it on our own and with increases such as NI further pressuring employment, it’s easy to be sceptical.

However, I see there are several factors that are bigger – whether it seems fair to me or not!

The Role of Steel in the UK Economy

Global instability

Firstly, as mentioned before, the world supply is unstable. It’s not long since supply of materials to the UK was held up in the Suez canal. Then the war in Ukraine following Russia’s invasion destabilising supplies. More recently Trumps decision to start a tariff war creating possibly the most unsettling position Industry has seen for years.

UK jobs

Secondly, UK Jobs. Without these significant industries, our UK economy will struggle and many of the skills which are essential in Industry will die and never return.

The debate in the House of Lords is heartening.

So why is it important to retain British Steel?

I can’t say it better than UK Steel’s report. The UK steel sector directly employs 33,700 people and a further 42,000 in the wider supply chain, paying wages on average 26% higher than the national median and 35% higher than the regional median in Wales, Yorkshire and Humberside where the majority of steel jobs are located. In 2023 the UK steel industry directly contributed £1.8 billion to the UK economy and an added £2.4 billion through supply chains, as well as £3.4 billion to the UK’s balance of trade.

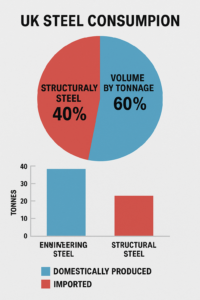

These challenges underscore the importance of strategic investment and policy support to bolster domestic steel production and reduce dependence on imports. The UK continues to produce engineering steel, though on a relatively modest scale compared to structural steel.

The Department for Business and Trade wrote…

The decisions over the future of the British Steel were not ones made lightly. But they were made, and will continue to be, with the interests of working people and UK industry at heart. Not only am I heartened by this news but as an employer I understand the weight of responsibility to maintain employee’s livelihoods. Immense pressure lifted for the highly skilled workforce British Steel – great news.

Government policy turnaround

Business Secretary Jonathan Reynolds MP said supporting British Steel is “the right thing to do” as he toured our operations. Seeing iron being tapped at our Scunthorpe blast furnaces. We are focused on maintaining Britain’s last 2 blast furnaces and manufacturing the steel the UK needs now and in the future.

Politics aside, I cannot help but agree that we need to manufacture steel in the UK. Whoever is in power, this fact remains. However the debate continues about the future, see the comment on the vote by the BBC.

The Future for the UK

In 2023, the UK consumed approximately 893,000 tonnes of structural steel for construction and infrastructure projects. This figure reflects the total volume of constructional steelwork used a cross sectors such as commercial buildings, industrial facilities, and infrastructure developments. For further reading take a look at britishsteel.co.uk and bcsa.org.uk.

In 2023, the UK consumed approximately 893,000 tonnes of structural steel for construction and infrastructure projects. This figure reflects the total volume of constructional steelwork used a cross sectors such as commercial buildings, industrial facilities, and infrastructure developments. For further reading take a look at britishsteel.co.uk and bcsa.org.uk.

Looking ahead, forecasts suggest that structural steel consumption in the UK will grow modestly, reaching around 897,000 tonnes by 2028, driven by ongoing demand in various construction sectors.

Overall, structural steel accounts for a significant portion of the UK’s total annual steel consumption, which ranges between 9 to 11 million tonnes, encompassing all applications including manufacturing and other industries

In 2023, the UK consumed approximately 893,000 tonnes of structural steel for construction and infrastructure projects. However, a significant portion of this steel was imported. The UK produced about 5.6 million tonnes of steel in total that year, but only a fraction of this was used domestically for structural applications .

According to UK Steel, domestic steel producers supplied just 40% of the UK market in 2023, with imports accounting for the remaining 60%. Applying this ratio to structural steel consumption suggests that roughly 357,000 tonnes of the 893,000 tonnes used were produced domestically, while approximately 536,000 tonnes were imported.

The UK’s reliance on imported structural steel is influenced by several factors, including high domestic energy costs, limited production capacity, and the ongoing transition to greener steelmaking technologies. For instance, the British Steel plant in Scunthorpe, the UK’s last blast furnace facility, is facing potential shutdowns due to supply disruptions and financial challenges.

Additionally, the UK exports about 80% of its 11 million tonnes of scrap metal annually, limiting the feedstock available for domestic electric arc furnace production.

The Impact of Trump’s Tariffs and Global Trade Uncertainty

Protectionist policies, such as President Trump’s steel tariffs, have had a lasting impact on global steel markets. While designed to protect American steelmakers, these tariffs triggered retaliatory measures and disrupted traditional trade relationships.

For the UK these tariffs, along with broader geopolitical trade tensions, have posed challenges for steel exports. The risks of market fragmentation and the ongoing uncertainty surrounding trade relationships post-Brexit add further complexity. While President Biden has maintained some tariffs, global trade dynamics continue to evolve, leaving UK steel producers navigating an uncertain export market.

Engineering Steel Production in the UK

Engineering steel (used in applications like automotive components, machinery, and tools) is primarily produced using electric arc furnaces (EAFs), which melt scrap metal to create new steel. In 2023, the UK produced approximately 5.6 million tonnes of steel in total, encompassing various types including structural and engineering steels.

Key facilities contributing to engineering steel production include: Liberty Steel in Rotherham which operates an EAF with a capacity of around 1.2 million tonnes per year, focusing on high-grade steels for engineering and automotive sectors.

Nationalisation

I am not one for nationalising our industries, but with British Steel, as Sheffield Forgemasters, in these days of global instability, the case for nationalising is perhaps more compelling than at any time in the last 30 years.

Sheffield Forgemasters

Specialises in complex, high-integrity steel components for defence and energy industries. There is debate amongst some, as to whether British Steel should be Nationalised, as Forgemasters. The rationale behind this has some common values including:

National Security

Forgemasters has the capability to support our nuclear; not just defence. British Steel has this merit too.

It was nationalised primarily to secure the supply of critical steel components for the Ministry of Defence (MoD), particularly those vital for the Royal Navy’s ships and nuclear submarines. The company faced financial difficulties and the government deemed public ownership necessary to prevent the potential collapse of a key national defence supplier.

In many ways British Steel has similar assets for UKPLC. The UK’s reliance on imports for essential steel products, including those for Network Rail, raises concerns about national security, says the BBC. While exact figures for engineering steel production aren’t specified, these facilities represent the core of the UK’s engineering steel output.

Green steel

If the UK successfully transitions to green steel and secures long-term investment, the biggest winners could be:

- Steelworkers and manufacturing jobs: A sustainable steel industry would ensure employment stability and growth.

- Renewable energy sector: Increased steel demand for offshore wind and electric vehicles could boost UK supply chains.

- Consumers and businesses: Access to locally produced, low-carbon steel could lower costs and enhance industrial competitiveness.

However, there will also be losers:

- Traditional blast furnace operations: Companies that cannot transition to cleaner technologies may struggle or close.

- Export-dependent firms: If global trade tensions persist, UK steel exporters may find themselves at a disadvantage.

- Energy-intensive producers: High electricity costs remain a key challenge that could undermine competitiveness.

In Conclusion

The UK steel industry stands at a turning point. With government backing, technological innovation, and a shift toward Green Steel, the sector has the potential to thrive. However, external pressures such as trade tariffs, market competition, and corporate instability pose significant risks.

Whether Sanjeev Gupta’s promises will translate into tangible results remains uncertain, but one thing is clear: the future of UK steel depends on its ability to adapt to economic, environmental, and geopolitical realities.

It seems, to quote a cliché, that we are in unprecedented times.

For our nation to restrengthen its hand at this time seems like the right move. In doing so we will protect jobs, retain skills, aid transition to green steel, safeguard at least some of our infrastructural steel and support UK defence.

Mark Thornley

Managing Director, High Peak Steels